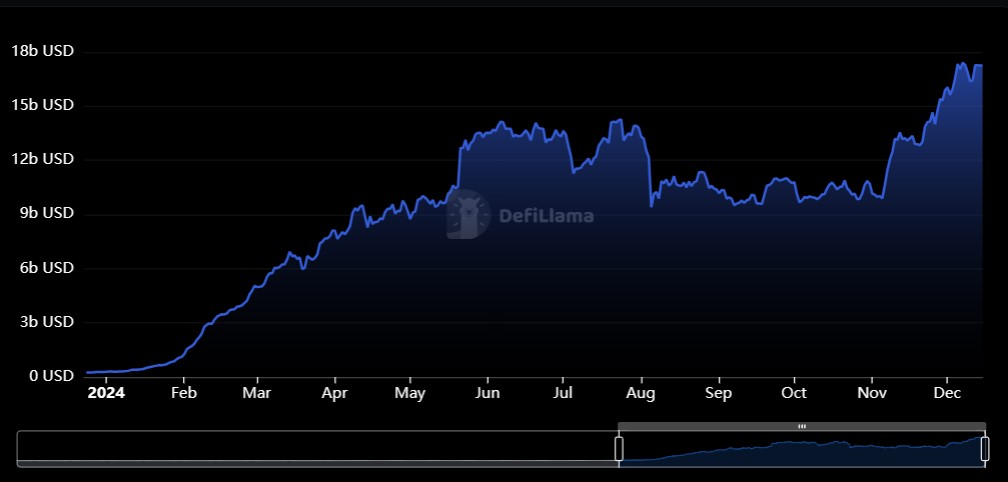

The total value locked (TVL) of liquidity restaking protocols on the Ethereum network has recorded an impressive increase of nearly 6,000% in 2024, with the demand for staked assets trending strongly upward.

According to data from decentralized finance (DeFi) data aggregator DefiLlama, the TVL of Ethereum liquidity restaking protocols hovered around $284 million on the first day of 2024. However, less than a year later, on December 15, this number exploded to $17.26 billion, nearly 60 times more than at the beginning of the year.

What is Liquidity Restaking?

Tokens called liquidity restaking tokens (LRT) have been developed on the solid foundation of liquidity staking tokens (LST).

To clarify, in liquidity staking transactions , users who own ETH and want to participate in the process of securing the Ethereum network while maintaining liquidity for their assets will receive derivative tokens such as stETH from the Lido service. These tokens not only represent the assets they have staked, but can also be used in many other decentralized finance (DeFi) activities, such as trading, lending, or yield farming methods.

Here is a comparison table between LST vs. LRT:

| Characteristic | LST | LRT |

|---|---|---|

| Purpose | Tokenize staked assets to increase liquidity | Allows re-use of staked assets for additional security activities |

Main use cases |

Boost liquidity and participate in DeFi | Security for multiple networks or protocols |

Capital efficiency |

Moderate: Focus on staking in a single chain | High: Multiply staking opportunities |

Ecosystem benefits |

Enabling liquidity and composability in DeFi | Enhanced security and multi-chain infrastructure |

| Risk | Devaluing derivative tokens | Increased risk levels associated with specific networks |

As for liquidity restaking, users who staked ETH to secure the Ethereum network can continue to stake the derivative tokens received to participate in securing application-specific blockchains or Layer-2 networks.

While these assets can be used flexibly, they also come with their own risks. Price fluctuations or devaluation of the derivative token can affect the value of the staked asset.

Participating in multiple networks at the same time exposes LRTs to greater risk. If one network fails, staked assets can be affected and lead to compounding losses.

Ether.fi holds over 50% of LRT market share

The Ether.fi protocol involved in liquidity restaking currently holds more than 50% of the total value locked (TVL) of the LRT market, with total assets restake reaching $9.17 billion.

A report from Node Capital points out that Ether.fi’s success comes from its user-friendly restaking model. The report states:

“This dominance shows that the platform has succeeded in simplifying complex restaking operations into an easy-to-use token model that automatically accumulates value.”

While the liquidity restaking model offers great potential for optimizing capital efficiency and network security, users should also carefully consider the risks before participating in these protocols.