The desire to become a millionaire quickly has been a staple since the inception of Bitcoin. From Tulips to Slerf, there is no shortage of investments that promise to get rich overnight. However, there may be a more effective investment strategy that considers risk and reward. Timing is key in investment decisions, but achieving accuracy in this area can be quite difficult. A more conservative approach has proven to be one of the most effective investment strategies: dollar-cost averaging (DCA).

DCA into Bitcoin generates outstanding returns

The DCA strategy, also known as “Periodic Averaging,” involves investing a fixed dollar amount in a given asset on a regular basis over time. The goal of this method is to reduce market volatility by spreading out purchases. One of the benefits of this approach is that it allows investors to make multiple trades at lower prices as well as higher prices, which makes it an attractive option for highly volatile assets like Bitcoin (BTC).

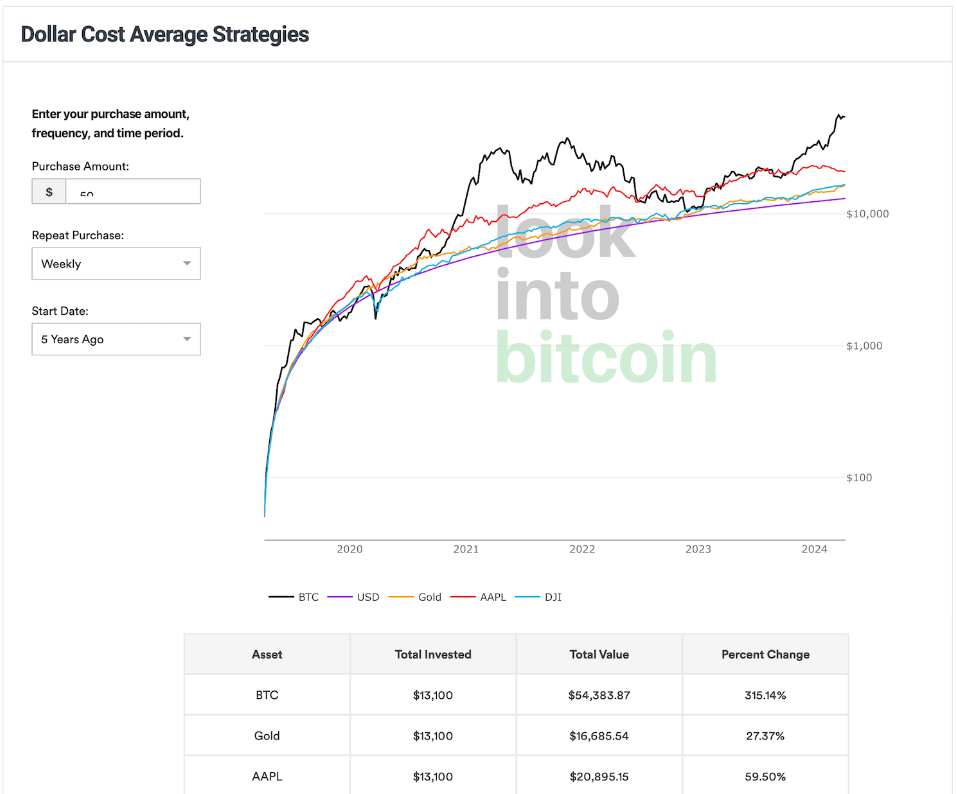

For example, if an investor decided to spend $50 per week or $200 per month on Bitcoin starting in July 2019, they would have earned a very good return of 345.9% by January 2024. With an initial investment of just over $13,000, the current asset value would be nearly $58,193. In comparison, investing in gold over the same period would have returned a meager 24.9%, and it is worth noting that the Dow Jones Industrial Average (DJI) did not even record a 1% increase during this period.

Meanwhile, Apple stock saw a remarkable increase of 64.4% over the same time frame, with the total DCA strategy value reaching $21,400. However, it is important to note that Bitcoin’s volatility is significantly higher than traditional assets. For example, from 2020 to 2021, Bitcoin’s closing price increased by $46,387 on December 31, 2021, marking a staggering increase of 543.1%.

However, this rapid rise was accompanied by a sharp drop of more than 65% from November 2021 to November 2022, highlighting the extreme volatility inherent in the cryptocurrency market.

The unpredictable nature of rallies, coupled with Bitcoin’s inherent volatility, can make it difficult for investors to maintain their positions for a given period of time. While DCA can be effective, it depends heavily on the investor’s confidence in the chosen asset.

DCA is an easy way to accumulate BTC

Dollar-cost averaging can be very useful for new investors looking to diversify their cryptocurrency portfolio. By investing a set amount, such as $50 per week, regardless of market conditions, investors are able to spread their purchases over a long period of time, thereby minimizing the risk of price fluctuations.

This strategy helps mitigate the impact of price volatility, allowing investors to benefit from the asset’s long-term growth potential. In a recent statement, Daniel Masters, president at CoinShares, said:

“With annual volatility at 75% or more, we know BTC’s price path will see many highs and lows in the short term. Dollar-cost averaging is an easy way to accumulate positions while avoiding too much concentration of risk at any one time.”

For new investors who are looking to get into investing, DCA (time-weighted averaging) offers a fairly simple and easy-to-understand approach. Instead of having to laboriously analyze the market and make large trades at once (which can be difficult and risky), DCA allows investors to build their positions slowly and sustainably over time. This method not only reduces stress but also builds confidence for beginners, as they can approach the market in a more gradual and controlled manner.

The best Bitcoin (BTC) investment strategy often depends on the risk tolerance of each investor. However, dollar cost averaging (DCA) is considered a reasonable option to increase the number of BTC during times when the market is growing strongly. Applying DCA can help investors minimize the impact of price fluctuations and thereby easily accumulate the assets they desire.