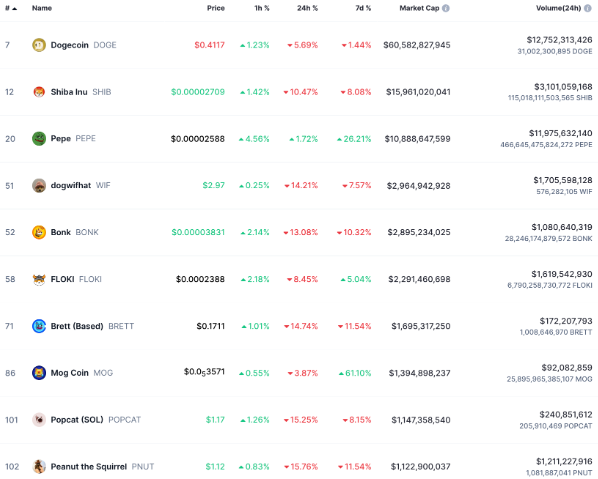

It is noteworthy that memecoins like Dogecoin, Shiba Inu, and Dogwifhat performed poorly on December 10. These cryptocurrencies have lost much of the gains they accumulated during the Donald Trump-fueled price surge just weeks ago. This is a serious decline and shows the high volatility of the cryptocurrency market that investors need to consider.

Memecoin Market Cap Takes a Hit

Memecoin’s latest price drop has sent the total market capitalization of the sector to a three-week low of $119.6 billion as of December 10. The last time memecoin’s market capitalization fell below $120 billion was on November 27 when it stood at $118 billion. The total market capitalization of all cryptocurrencies in the sector has fallen 21% in the past 24 hours.

Total daily trading volume across the entire memecoin sector has nearly doubled compared to the previous day, indicating a very strong increase in selling pressure over the past 24 hours.

Dogecoin , the largest memecoin by market capitalization, led the way with a 5.6% decline over the past 24 hours. Meanwhile, DOGE competitor SHIB also saw a significant decline, with a loss of 10.4% today. In contrast, Pepe, an Ethereum-based coin, was the only memecoin among the group to see a slight increase of 1.7%.

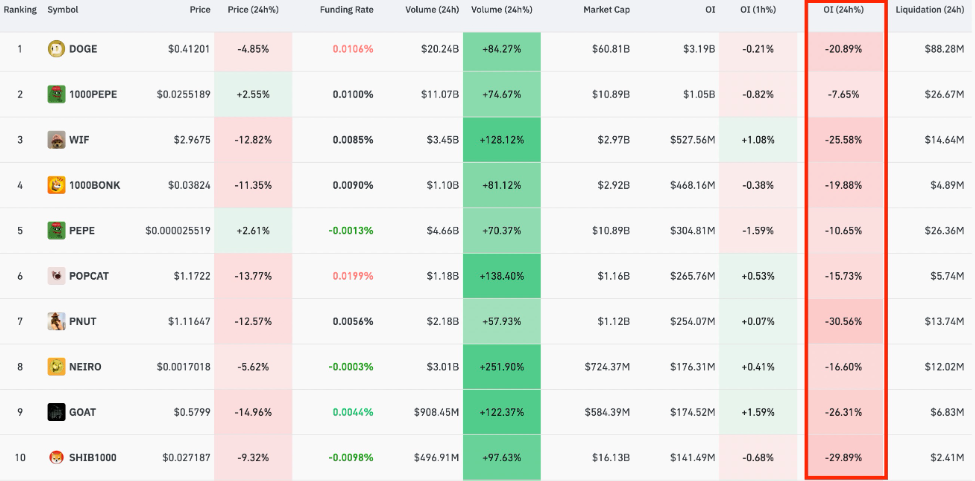

Memecoin OI Drops Sharply

Memecoin’s drop on December 10 came after open interest (OI) fell, with Pnut (PNUT) leading the way as OI fell by 30% in the past 24 hours. Open interest refers to the total number of pending derivative contracts that have not yet been settled. In futures, for every seller, a buyer is required to settle the contract.

DOGE has seen a significant decline in its value, with its OI (Open Interest) dropping more than 20% in a day, now sitting at $3.1 billion. WIF’s OI has also not fared much better, dropping 27% in the same time period to $519 million. As for PEPE, its OI is at $302.4 million, down about 11%.

In this context, the decline in OI for memecoins clearly shows the weakening of market momentum. Many traders who tend to use leverage are looking to close contracts as they predict that prices will continue to fall in the near future.

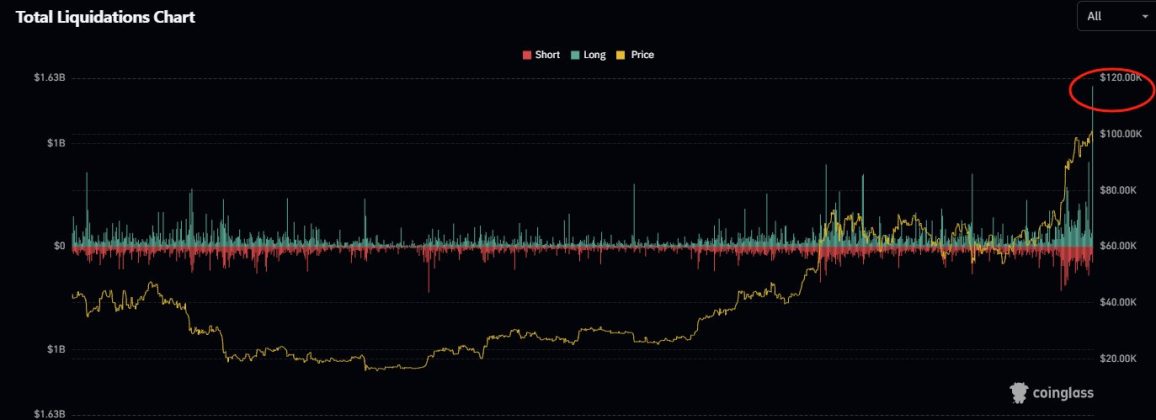

Massive Liquidation Accompanies Memecoin Crash

The cryptocurrency market crash has wiped out over $1.7 billion in leveraged positions in just the past 24 hours, with over $1.3 billion wiped out in a 12-hour period. “This is by far the largest long liquidation in the current bull run,” CoinGlass reported on December 10 on the X platform.

According to data from CoinGlass, futures contracts tracking smaller altcoins and meme tokens recorded higher losses than BTC or ETH futures in the unusual move.

Over $72.6 million in DOGE longs and over $22.35 million in SHIB longs accounted for the majority of liquidations on memecoin over the past half-day. Similarly, over $7.9 million in PEPE longs and $3.6 million in WIF longs were liquidated over the same period.

This liquidation event is considered the largest since 2021, marking the beginning of a bear market period in 2022. A similar liquidation event occurred recently, accompanied by a rapid collapse on December 5, when more than $816 million in long positions were removed from the derivatives market, compared to just $280 million from shorts.

During the event, the price of BTC dropped by 11% to $92,000, causing a sell-off in altcoins, including memecoin. DOGE fell by 12% on the same day, while the memecoin sector lost $1 billion in market capitalization.

You can see coin price here.

This article is for informational purposes only and is not intended to be investment advice. Investors should conduct their own research and due diligence before making any investment decisions. We would like to emphasize that we are not responsible for any investment decisions you may make.