Memecoin has experienced a meteoric rise in price over the last year, including upstarts like Pepe (PEPE) , Dogwifhat (WIF) , and Popcat (POPCAT), which have increased by over 30,000% since their inception.

Is the Memecoin trend coming to an end?

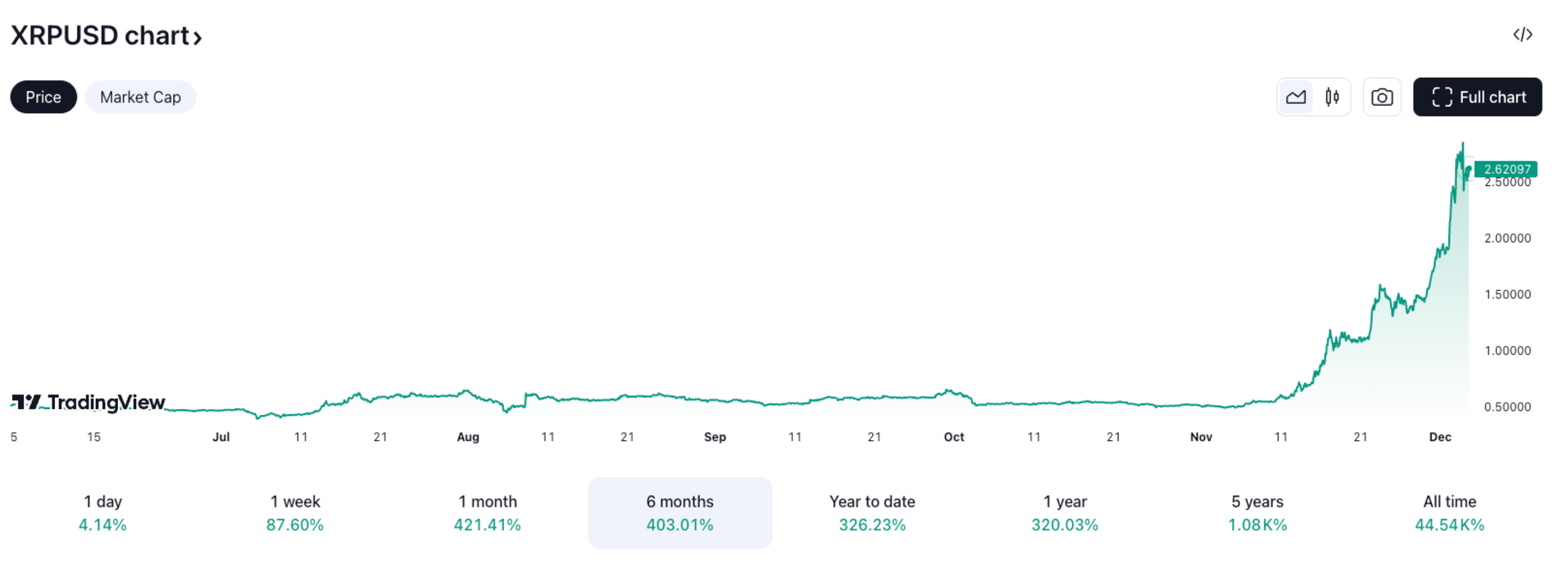

Many memecoin proponents believe that new retail investors will emerge and push prices higher. However, they seem to be paying more attention to “Dino Coins” like XRP and TRX . The recent prominent memecoins, with the exception of Bonk (BONK) and Pepe, have failed to reach all-time highs, leading to concerns about the end of the “memecoin supercycle.”

Murad Mahmudov introduced the concept of a “memecoin supercycle” in September at the Token2049 conference in Singapore, highlighting memecoin’s superior performance compared to legitimate projects.

Memecoin is a hyper-speculative crypto asset that offers no utility or benefit, yet has surged due to a lack of fundamentals. Mahmudov believes that the memecoin supercycle is just beginning. He also notes that the real value of memecoin cannot be measured using conventional quantitative techniques in finance.

“If DeFi protocols actually start distributing dividends to token holders, this could change the way these assets are valued, because if there is a steady cash flow (like dividends), investors will use traditional financial valuation methods to value this asset.

The history of traditional finance, over 500 years, shows that assets with stable cash flows will be valued using metrics such as the price-to-earnings ratio (P/E ratio). Traditional investors will calculate the value of an asset based on its earning potential, and may question why they are paying such a high price (for example, a P/E ratio of 200 is very high).

However, if the asset is “memetic” (based on virality and influence in the community), valuation becomes more difficult. These assets may not follow traditional financial principles and may fluctuate strongly due to psychological factors, community influence or other social factors. Therefore, if an asset is “memetic”, no one can be sure of its exact valuation, and its value may increase or decrease unpredictably.”

Memecoin is just a leverage play on the global market

Mahmudov believes that the key to determining whether the memecoin supercycle is over lies in “global macro” factors, including interest rates, central bank policies, and general financial conditions.

“As long as global liquidity remains strong and risk appetite persists in traditional markets, memecoin will continue to perform strongly. However, in the event of a recession, memecoin may not be able to maintain its current level of performance.”

“In my opinion, cryptocurrencies in general are 2 to 3 times more volatile than traditional markets, while memecoins can be 7 to 8 times more volatile, depending on the global context.”

Swyftx analyst Pav Hundal agrees with Mahmudov’s view, arguing that memecoin is essentially a higher-risk leveraged play compared to the rest of the crypto industry, as well as the broader global financial markets.

If global market conditions tend to improve, memecoin has a chance to perform strongly. However, if the market reverses and financial conditions worsen, memecoin investors may face the risk of serious losses.

“All you need to understand about the current cycle is that global liquidity is high, regulatory risk is low and I expect the US dollar to weaken.”

“Like a trip to Monte Carlo, money is flowing everywhere and into risky assets. Technically, the current trend is bullish. If the market continues to rise, memecoin will follow.”

Hundal warned investors to brace for the impact of recent price increases, noting that “meme fatigue” could become a factor.

“The market may have gone a little further, but it is completely reasonable to expect a correction after a 150% rally,” he shared.

“It is not possible to rule out the possibility that in the future, factors like censorship, meme fatigue, or cancel culture will become risks for memecoin. We just saw CZ describe memecoin as a strange phenomenon,” Hundal added, echoing a tweet by former Binance CEO Changpeng Zhao on November 26.

Lennix Lai, chief trading officer at OKX, said that while the term “memecoin super cycle” may be a bit far-fetched, current market conditions suggest an “expansion” rather than an end cycle for memecoin and crypto assets.

However, Lai warned that the rapid emergence of the Solana ecosystem as a primary blockchain for new memecoins, coupled with the ephemeral nature of these assets, could lead to wild and unpredictable fluctuations in their value in the future.

“Traders should note that the crypto market will continue to see volatility in the short term, with Bitcoin likely to drop 10%-15% in the coming weeks, while memecoin could see much stronger price movements,” he said.

Memecoin is a “crypted community”

While memecoins are often considered “weird,” Mahmudov argues that it’s not all about irrational valuations or unreasonable price targets.

Mahmudov, who often describes memecoins as a profitable “cult” and uses religious imagery when talking about them, argues that these tokens not only offer hope for financial returns, but also impact the community’s beliefs and emotions.

“At the risk of sounding a little blasphemous, if you look at religion as a product, or rather a service, what does it do for people? It gives them meaning.”

“Memecoins are the same. They give people a sense of belonging to a community, creating identity, friendships and connections. They give people a sense of purpose and mission.”

For Mahmudov, it is this sense of community among memecoin owners that creates a positive feedback loop, boosting the value and purpose of the tokens, thereby strengthening the bond between participants.

Mahmudov even explained the recent outperformance of long-standing altcoins like XRP, ADA, and LINK by pointing to the “religious” nature of these communities.

“You need to understand the passion of the loyal members in these communities, that is the most powerful motivator.”

“The most optimistic thing you can expect from a real token is when participants become unpaid evangelists, voluntarily promoting the project without receiving any compensation. This has happened many times with XRP, Chainlink, Cardano, and Dogecoin.”

However, anonymous trader Kun has pushed back against the notion that any price movements stem from community devotion, stressing that the underlying belief in a token’s practical utility — whether justified or not — is the most important factor.

“The difference is that XRP holders truly believe in the fundamentals of the token. They don’t buy XRP just because they’re inspired by ‘cult’-like communities.

In fact, if you tell an XRP holder that the token is just a meme without any fundamentals to back it up, they will strongly disagree.”

Is Pump.fun harmful to memecoin?

The rapid rise of Solana-based Pump.fun has sparked a wave of controversy in the crypto community. Some analysts have criticized the protocol, calling it the “most powerful mining” product ever created, and warning that it could have an inevitable negative impact on the industry.

Other critics argue that the explosion of memecoins on the platform has distracted users’ attention from hundreds of thousands of new memecoins, thereby undermining the growth potential of larger “blue chip” memecoins on Solana.

On November 25, Pump.fun announced the suspension of its livestream function following criticism over harmful content streamed by users to draw attention to newly launched tokens.

Putting aside the controversy surrounding livestreaming, Mahmudov argues that the ability to create memecoins with just one click is an inevitable step forward in technological development:

“It’s pointless to criticize Pump.fun. Creating memecoins with a single click was inevitable. It’s the natural evolution of techno-capitalism, where everything is tokenized, tokenized into memes, and eventually turned into coins.”

Ultimately, Mahmudov argues that Pump.fun, as well as other simple token generation platforms, have actually split the industry into two distinct trends.

“One trend is gambling, where everything happens fast, like a super game. It’s all fleeting, a ‘flavor of the day’ kind of thing.”

“The rest is building a long-term community, building a brand, and creating a cult. Like Dogecoin, we can build the next $100 billion movement together. That’s the part I’m really interested in,” Mahmudov concluded.

This article is for informational purposes only and is not investment advice. Investors should do their own research before making any investment decisions. We are not responsible for your investment decisions.