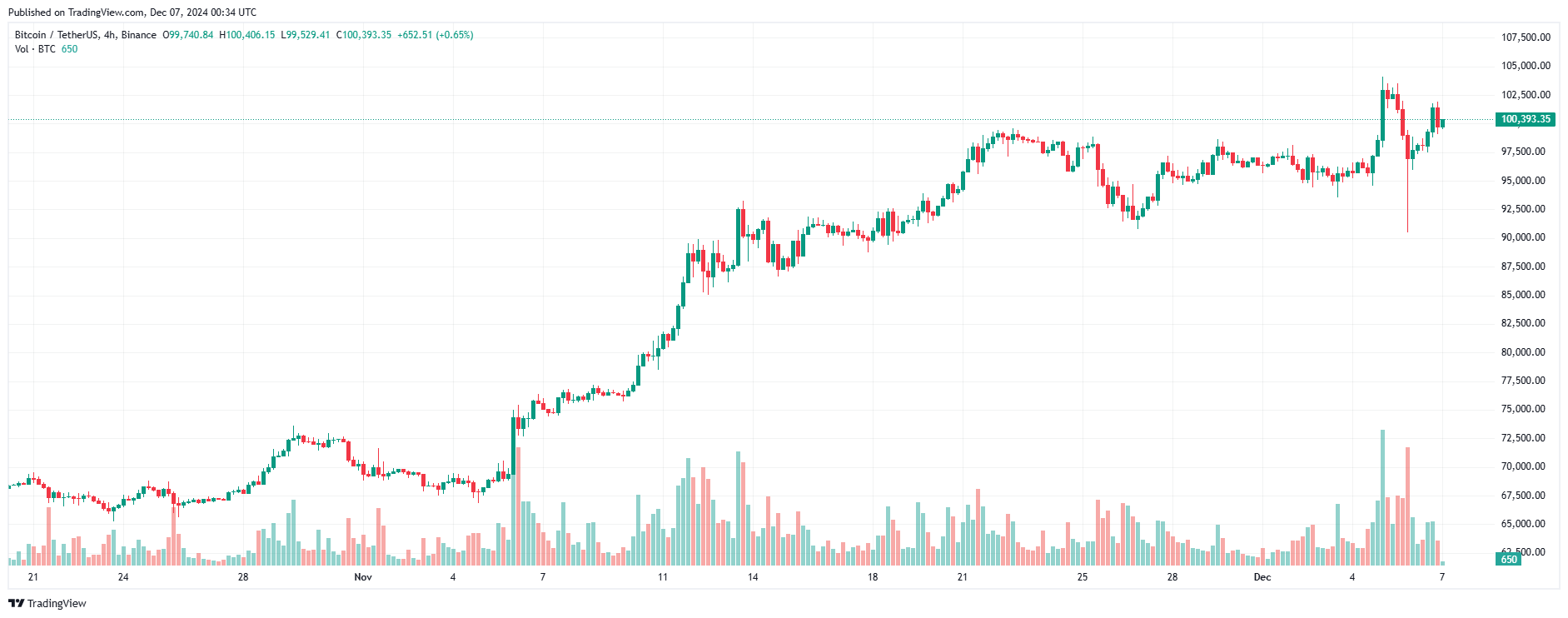

Bitcoin has recovered and returned to the psychologically important price level of $100,000, after a strong correction yesterday. This shows the appeal and stability of this cryptocurrency, despite experiencing significant market volatility.

US stocks

The S&P 500 and Nasdaq Composite hit new records on Friday after November jobs data came in slightly better than expected, but not so strong that it could prevent the Federal Reserve from cutting interest rates again later this month.

Specifically, the S&P 500 index recorded an increase of 0.25%, closing at 6,090.27 points. Meanwhile, the Nasdaq index, which mainly focuses on the technology sector, had a more impressive growth, increasing 0.81% to 19,859.77 points, thanks to support from the stocks of Tesla, Meta Platforms and Amazon. Both set all-time highs (ATH) during the trading session and closed the session with record numbers. On the other hand, the Dow Jones industrial average had a mixed performance, falling 123.19 points, equivalent to 0.28%, to close at 44,642.52 points.

The S&P 500 and Nasdaq also continued their three-week winning streak, rising 0.96% and 3.34%, respectively. Meanwhile, the Dow posted a slight decline of 0.6% over the same period.

The November jobs report, released Friday morning, showed nonfarm payrolls rose by 227,000 last month, beating the Dow Jones estimate of 214,000 and marking a big increase from October’s revised gain of 36,000. The unemployment rate edged up slightly to 4.2%, as expected.

After the less-than-hot unemployment data, the CME Group FedWatch Tool puts the probability of another rate cut in the next two weeks at 85%. “The labor market is not as strong, but it’s still pretty solid from an economic perspective, which gives the Fed room to continue cutting rates,” said Luke O’Neill, portfolio manager at Catalyst Funds.

Given the continued strength of the US economy, Fed Chairman Jerome Powell has previously said that policymakers do not need to “rush to lower interest rates.”

Bitcoin and Altcoins

After setting a new ATH around $103,900 on December 5, BTC faced a sharp correction shortly after, pulling the price back to near $90,000, causing more than $1.1 billion in crypto market liquidation.

However, the bulls stepped in, preventing the price from falling further and have now successfully brought BTC back to the psychological $100,000 mark once again. The leading asset is currently trading around $100,390, up nearly 3% in the last 24 hours. The Altcoin market continues to show impressive performance over the past few days.

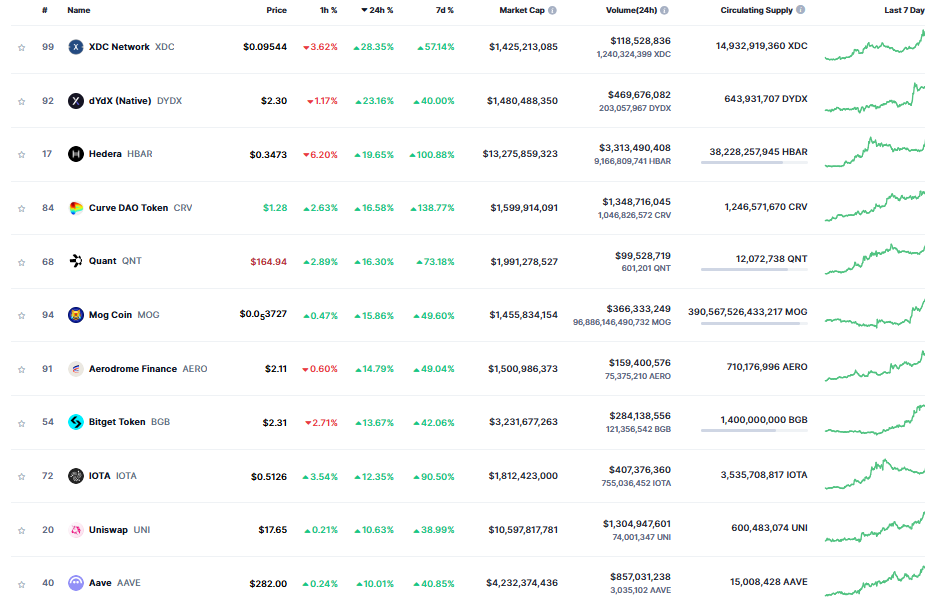

It can be seen that XDC Network (XDC) and dYdX (DYDX) are leading the market as both projects have recorded strong growth of more than 20%, pulling them back into the top 100 largest capitalization projects today.

In addition, many other tokens have also achieved double-digit profits today, such as Hedera (HBAR), Curve DAO Token (CRV), Quant (QNT) , Mog Coin (MOG), Aerodrome Finance (AERO), IOTA (IOTA), Bitget Token (BGB), Uniswap (UNI), Aave (AAVE) and many others.

Ethereum (ETH) also surged yesterday, pushing the price above the $4,000 zone and setting a local top at $4,087, the highest level since mid-March 2024. Currently, ETH bulls are still trying to hold the price above the $4,000 mark in hopes of continuing the explosive growth towards a new ATH.

You can see coin prices here.

This article is for informational purposes only and should not be construed as investment advice. Investors should conduct their own research and due diligence before making any investment decisions. We are not responsible for the investment choices you make.