Bitcoin set a new all-time high (ATH) of $104,088 yesterday, marking a significant milestone as the crypto asset crossed the $100,000 threshold for the first time. This event not only demonstrated the strong growth of Bitcoin but also attracted great attention from the investment community and crypto enthusiasts around the world.

US stocks

Stock futures were flat Thursday evening as investors awaited key payroll data. Dow Jones Industrial Average futures were down 21 points, or less than 0.1%, while S&P 500 and Nasdaq 100 futures were down about 0.1%.

Several companies reported strong quarterly results shortly after the closing bell, leading to a sharp rise in their stock prices. Ulta Beauty shares unexpectedly jumped 12% after reporting better-than-expected earnings and revenue for its fiscal third quarter. Companies like GitLab and Docusign also saw significant gains, with their shares rising 7% and 14%, respectively.

Investors are now eyeing Friday’s jobs report, which is expected to provide a clearer picture of the health of the domestic labor market and shape the Federal Reserve’s interest rate decision at its policy meeting on December 17-18. Economists polled by Dow Jones expect nonfarm payrolls to increase by 214,000 in November, marking a sharp increase from just 12,000 in October.

“With the market expecting a solid recovery in payrolls, the stronger-than-expected number could force the Fed to think harder about the pace of rate cuts next year,” said Charlie Ripley, senior investment strategist at Allianz Investment Management.

Given the strength of the US economy, Fed Chairman Jerome Powell has previously said policymakers do not need to “rush to lower interest rates.”

Stocks ended Thursday lower, retreating from the record highs the major indexes set earlier in the session. So far this week, the S&P 500 has gained 0.7%, while the tech-heavy Nasdaq Composite has gained 2.5%. The Dow Jones Industrial Average, which includes 30 large stocks, has seen a modest decline of 0.3% over the period.

Bitcoin and Altcoins

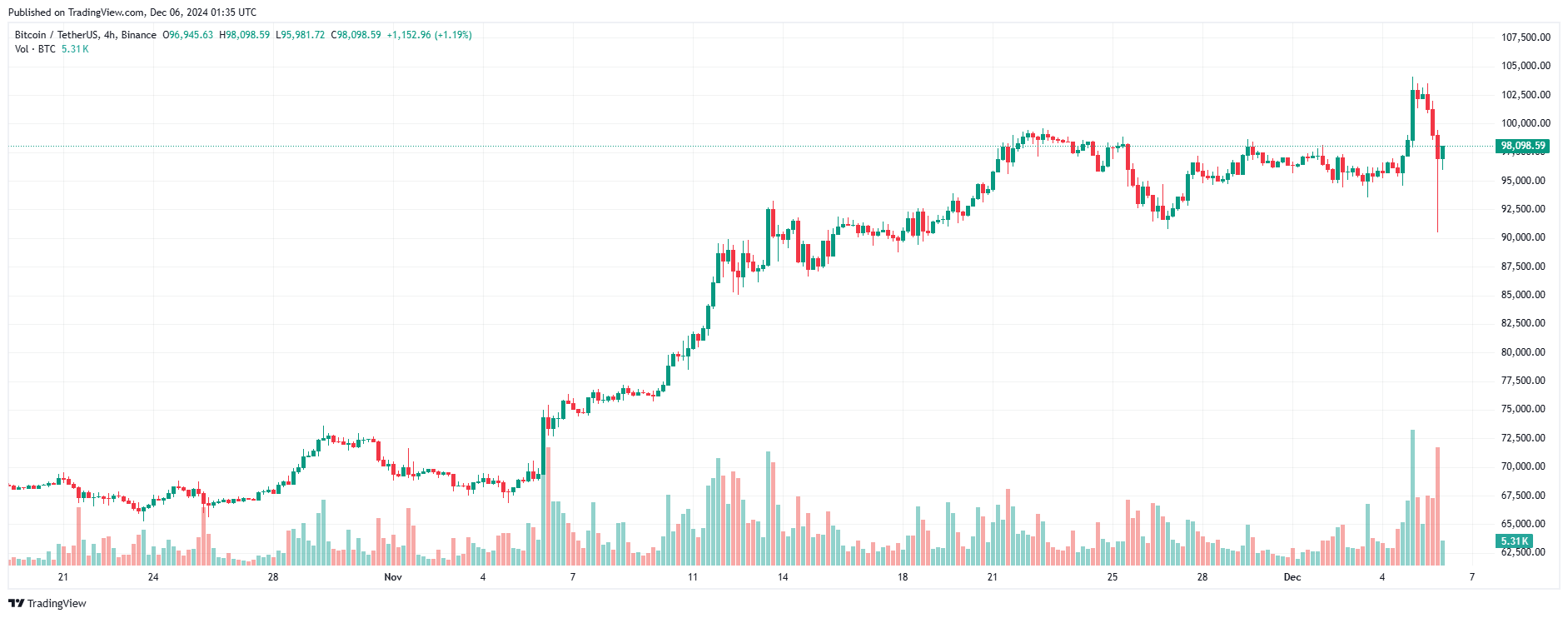

Bitcoin crossed the $100,000 mark for the first time in 15 years. The leading asset set a new ATH at $104,088 before facing strong profit-taking pressure.

Selling pressure sent the price plunging more than 10% from its peak, briefly falling to $90,500. Buyers then stepped in, pushing the price back above $98,000 at the time of writing.

Over the past 24 hours, approximately $1.1 billion in leveraged positions were liquidated , affecting 207,992 traders worldwide. Bitcoin accounted for $562 million of the total liquidations, followed by ETH with $109 million. Long traders, who bet on higher prices, suffered the most losses, with $815 million in positions liquidated – 74% of the total. Most altcoins in the top 100 gained yesterday.

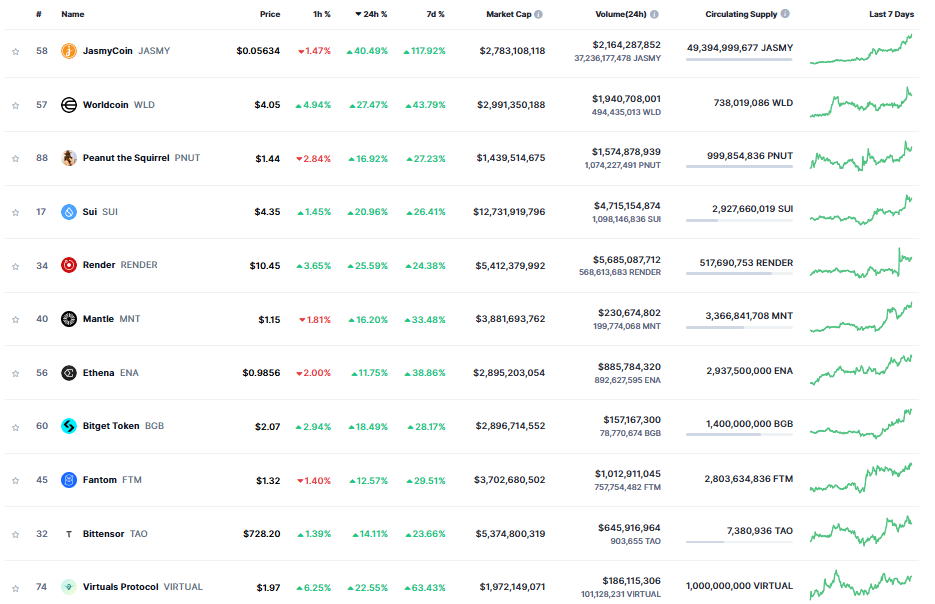

Leading the way is JasmyCoin (JASMY) as the memecoin recorded a growth of over 40%. On the weekly timeframe, JASMY has increased by over 110%. Worldcoin (WLD), Render (RNDR) , Virtuals Protocol (VIRTUAL), Sui (SUI) also made it to the top performing projects in the past 24 hours as they surged over 20%.

Other projects such as Bitget Token (BGB), Peanut the Squirrel (PNUT), Mantle (MNT) , Artificial Superintelligence Alliance (FET), NEAR Protocol (NEAR), Bittensor (TAO), Fantom (FTM), Ethena (ENA), Jupiter (JUP)… all increased by more than 10%.

Ethereum (ETH) is currently facing strong profit-taking pressure, after reaching a high of $3,956, which is also its highest local high since late May 2024. This comes as Bitcoin (BTC) has surpassed the $100,000 threshold. The resulting activity sent ETH prices tumbling below $3,700 and ending the previous trading day in the red. However, the situation seems to have improved somewhat, as Ethereum prices have now recovered to around $3,890.

You can see the coin price here.

This article is for informational purposes only and is not intended to provide any investment advice. Investors are advised to conduct their own research and due diligence before making any investment decisions. We are in no way responsible for any investment decisions you make.