For the first time in history, Bitcoin price has hit the $100,000 mark, marking a major milestone for the cryptocurrency market after a year of strong and significant growth. This not only represents the impressive price increase of Bitcoin but also reflects the recovery and development of the entire crypto industry.

Bitcoin Price Hits $100,000 for First Time

US stocks

US stock futures settled flat on Wednesday night, with little change after a day in which stocks set records.

Specifically, futures contracts related to the Dow Jones Industrial Average fell slightly by 18 points, corresponding to a decrease of 0.04%. Meanwhile, the S&P 500 futures contract also saw a decrease of 0.08%, and the Nasdaq-100 futures contract decreased by 0.1%.

Shares of American Eagle fell more than 13% in after-hours trading after the retailer issued a disappointing forecast for the final quarter of the year. Meanwhile, shares of retailer Five Below surged about 14% after reporting better-than-expected third-quarter results.

On Wednesday, all three major market indexes posted solid gains, with the S&P 500 and Nasdaq Composite hitting new closing records. In particular, the Dow Jones Industrial Average closed above 45,000 for the first time.

The event comes amid a report from ADP on Wednesday morning showing private payrolls grew less than expected in November. Specifically, companies added 146,000 jobs this month, while economists surveyed by Dow Jones expected an increase of up to 163,000 positions.

Investors are now awaiting key economic data to be released this week. Initial jobless claims data for the week ending November 30 is scheduled to be released on Thursday. Additionally, nonfarm payrolls data for November will be released on Friday.

On Wednesday, in an on-stage interview at the DealBook Summit, Federal Reserve Chairman Jerome Powell said that the US economy is strong enough for the Fed to be cautious about cutting interest rates.

“The labor market is getting better and the risks seem to be less in the labor market,” he said. “Growth is stronger than we thought and inflation is picking up a little bit. So the good news is that we can be more cautious in trying to find neutral.”

According to the CME FedWatch tool, there is a 78% chance the central bank will cut rates by a quarter point at its December 17-18 meeting, but they imply a nearly 64% chance that policymakers will leave rates on hold in January.

Meanwhile, several other earnings reports are scheduled to be released Thursday before the market closes, including Dollar General, Signet Jewelers and Kroger. Hewlett Packard Enterprise and Ulta Beauty are also scheduled to report later in the day.

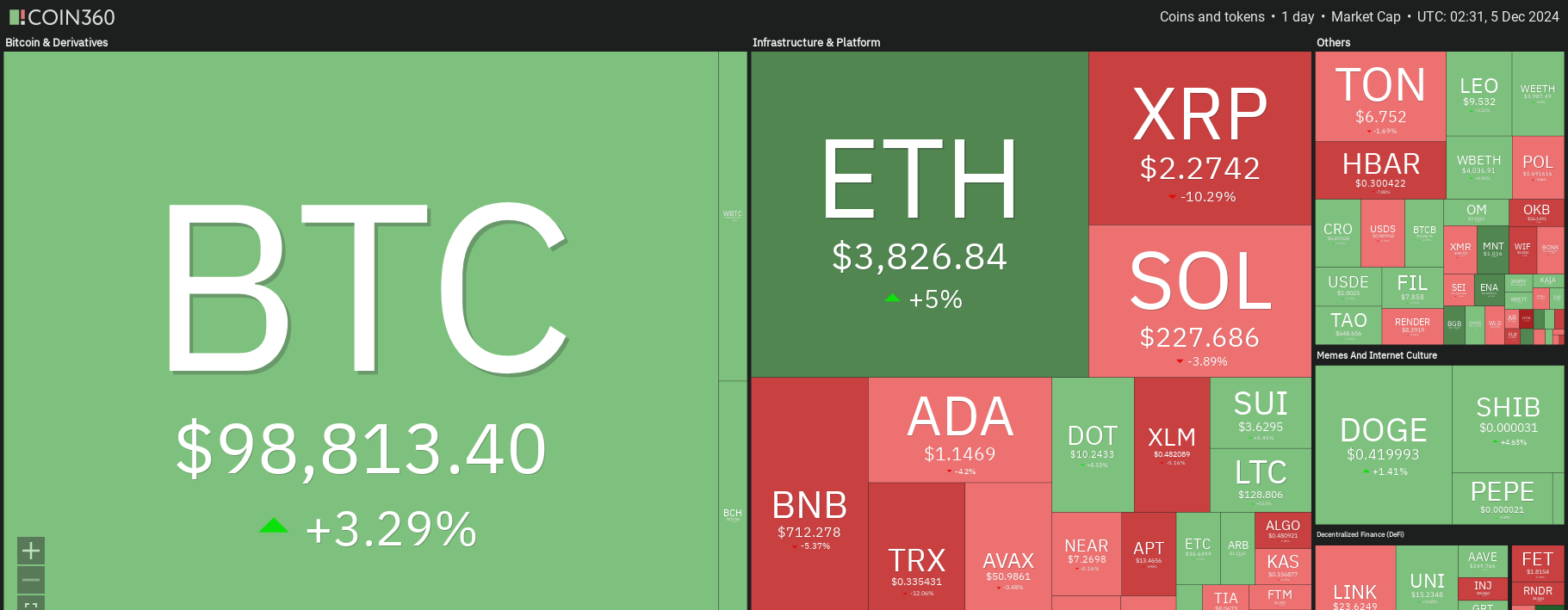

Bitcoin and Altcoins

On December 5, Bitcoin reached the $100,000 price threshold, surpassing the important psychological level just weeks after it hit $90,000 on November 12.

This year, more than $31 billion in new money has poured into Bitcoin ETFs in the United States, while supply has also become more limited following Bitcoin’s fourth halving in April.

Since the start of the year, Bitcoin’s value has increased by 126%, starting from around $44,000 on January 1.

As Bitcoin hit $100,000, its market capitalization also hit a new record, surpassing the $2 trillion mark for the first time.

On the positive side, Curve DAO Token (CRV) is the top performer as its price surged over 20%. The announcement of the launch of the scrvUSD stablecoin in the Spectra ecosystem has fueled this strong growth. Over the past 7 days, CRV has seen a surge of nearly 110%.

The Sandbox (SAND), Gala (GALA) and Ethena (ENA) followed closely with recent gains of over 10%.

Other projects such as Mantle (MNT), Beam (BEAM), Decentraland (MANA), BitGet Token (BGT), Bitcoin SV (BSV), Filecoin (FIL), Polkadot (DOT), Cronos (CRO), Flow (FLOW), Shiba Inu (SHIB),… also recorded a recovery of 5-9%.

In contrast, IOTA (IOTA) and Tron (TRX) showed signs of correction after a period of strong growth, with a drop of more than 10% yesterday. Hedera (HBAR), Algorand (ALGO), EOS (EOS), OKB (OKB), … lost 6-8% of their value. Yesterday, the price of Ethereum (ETH) increased sharply by 6%, ending a streak of 2 consecutive days of decline.

Currently, ETH has reached a local top of $3,887, which is the highest recorded since late May 2024. The bulls are struggling to maintain the price above the $3,800 mark, bringing with it hopes that a strong bullish wave is near.

This article is prepared for informational purposes only and is not intended to provide any investment advice. We advise you to conduct thorough research and consider carefully before making any investment decisions. Please note that we will not be responsible for the investment choices you make.