Bitcoin (BTC) has experienced two major liquidations in the Futures market with a total value exceeding $1 billion since December 5. It is worth noting that during this period, the value of Bitcoin has only fluctuated around $97,000. The most recent event caused a sharp volatility as the price of Bitcoin fell from $101,430 on December 8 to $94,200 on December 9. The resulting drop resulted in the removal of $2.9 billion from leveraged trading positions.

Bitcoin Corrects, But Markets Expect BTC to Hit $110,000 by February

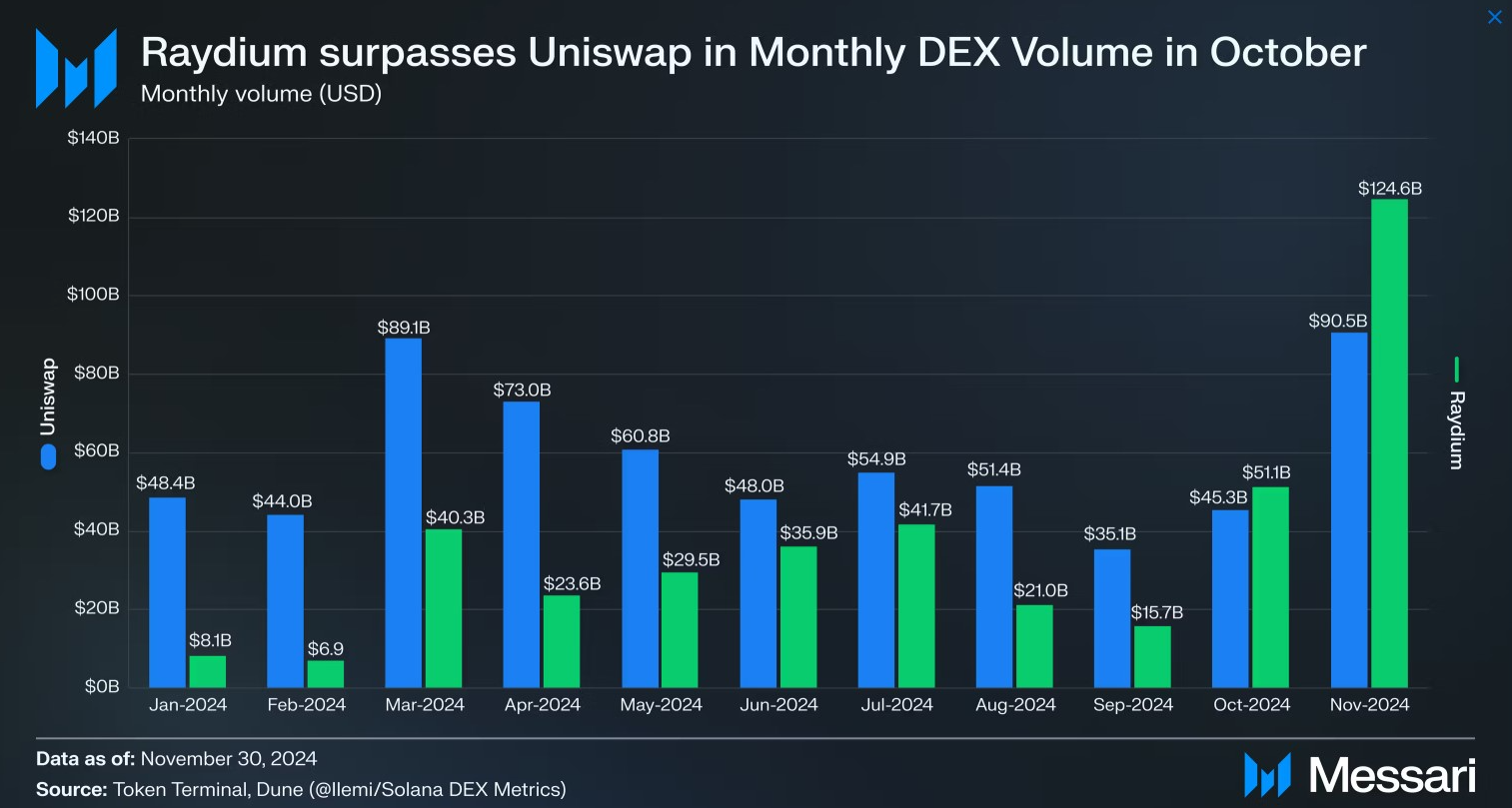

Despite the negative impact on short-term market sentiment, the Bitcoin derivatives market is now in a healthier state, which is necessary to trigger a sudden rally to new record highs. Traders tend to buy less when the market shows signs of overheating, such as high funding rates in the Futures market.

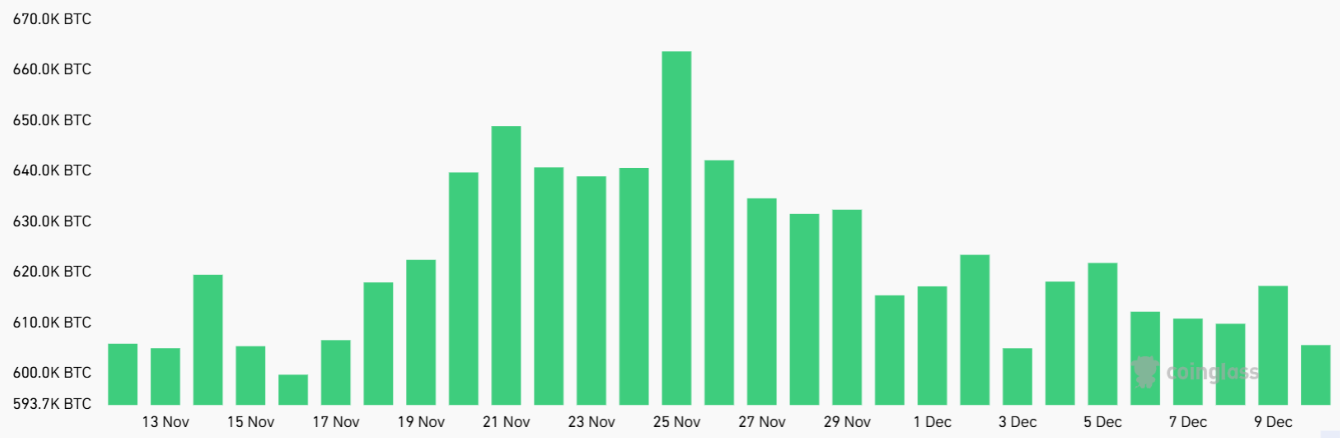

The total open interest (OI) of Bitcoin futures contracts decreased by 8% from November 25 to December 10, from 663,700 BTC to 609,400 BTC. However, despite the Bitcoin price dropping by $7,160 in 24 hours on December 9, the demand for leverage was not significantly affected.

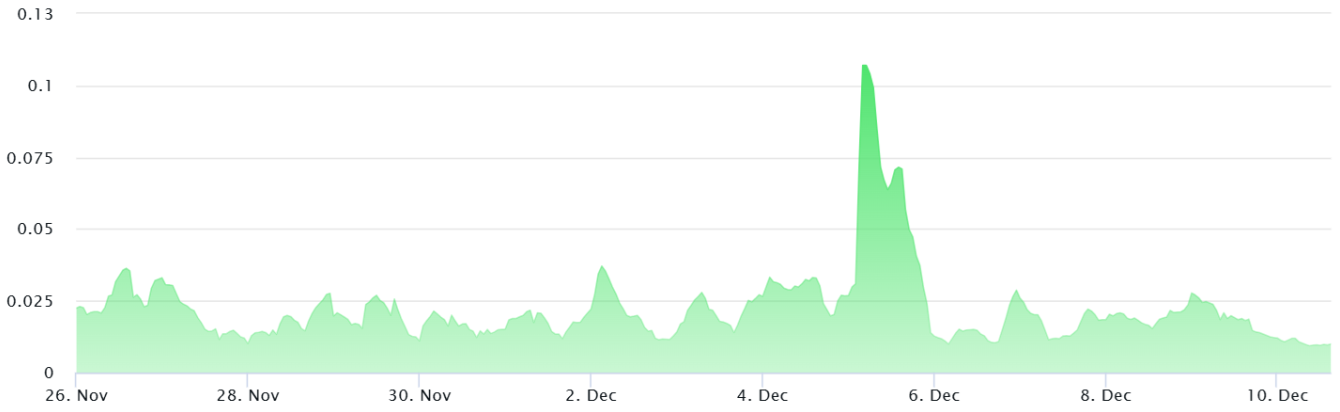

On December 5, the funding rate peaked at 9% per month. However, since the Bitcoin price dropped to $94,200 on December 9, the rate has almost returned to zero. This has led to the removal of excessive leverage by retail investors, a factor that often leads to chain liquidations in the market.

The volatility of Bitcoin’s price has made many new investors hesitant and reduced the appeal of the currency. However, the reduction in leverage has given existing investors confidence that the recent price increases are the result of accumulation, especially from institutional investors.

Bitcoin Aims for Further Gains as ETF Inflows Fend Off Short-Term Concerns

Traders are concerned that Bitcoin prices could come under pressure after a 72% gain in three months, but this short-term analysis does not take into account that U.S. spot Bitcoin ETFs have added $15.2 billion in assets since October 10, indicating strong demand.

MicroStrategy, Riot Platforms, and Marathon Digital (MARA) have been active Bitcoin investors in recent weeks. Between December 2 and 8, MicroStrategy purchased 21,550 BTC at an average price of $98,783 per Bitcoin, totaling $2.1 billion. Meanwhile, mining company Riot Platforms raised $500 million through a debt offering, largely to buy Bitcoin. MARA also significantly increased its Bitcoin holdings, adding 11,774 BTC to its balance sheet during the same period.

Unlike retail investors, whales and market makers remain bullish as monthly Bitcoin futures contracts still maintain a 15% premium to spot prices. Traders typically demand higher returns to compensate for longer settlement times, so a premium of 5% to 10% is considered neutral.

While the annualized spread of 21% on December 5 was quite high, it has now returned to a stable level compared to two weeks ago, suggesting that whatever factors caused the temporary spike in leverage demand have disappeared. From a derivatives perspective, this opens the door for further bullish positions, further strengthening the market’s growth momentum.

Data reinforces belief in positive outlook

To illustrate that professional traders are not turning bearish, a trader betting that Bitcoin will hit $100,000 by February 28 is now paying 0.112 BTC, or $11,000, for a call option. This suggests that the derivatives market is pricing Bitcoin at $111,000 in less than 80 days.

While the decline in open interest in Bitcoin futures can be seen as a positive sign, it would be naive to think that the market has completely lost its bullish mood. There is nothing wrong with maintaining a bullish outlook, especially with the inauguration of President-elect Donald Trump scheduled for January 20. However, cryptocurrency traders often use financial leverage, so price fluctuations still have the potential to create unexpected shocks in the market.

This article is for informational purposes only and is not an investment recommendation. Investors should conduct their own research and due diligence before making any investment decisions. We are not responsible for any investment decisions you make.