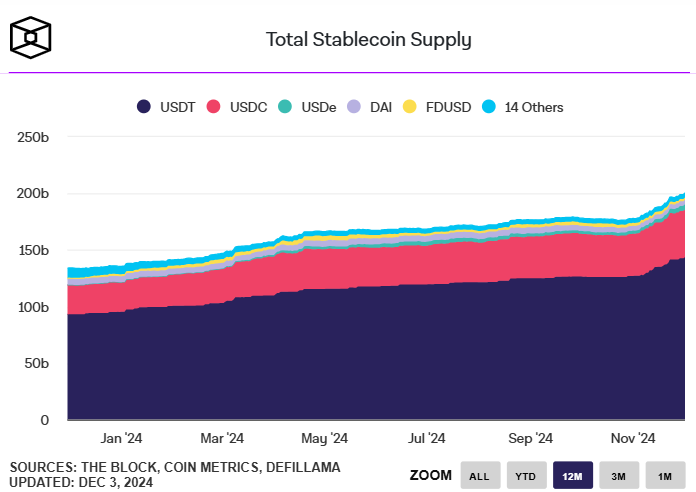

According to CoinGecko, the total market capitalization of stablecoins has reached an all-time high, surpassing $200 billion. This represents a significant increase of 13% in just the past month. In addition, data on the total stablecoin supply, including unissued USDT that Tether holds in its treasury, has also exceeded $200 billion. Analysts believe that this boom is mainly due to investors looking for investment opportunities with more attractive yields on DeFi platforms.

The total market capitalization of stablecoins has hit $200 billion as on-chain lending interest surges.

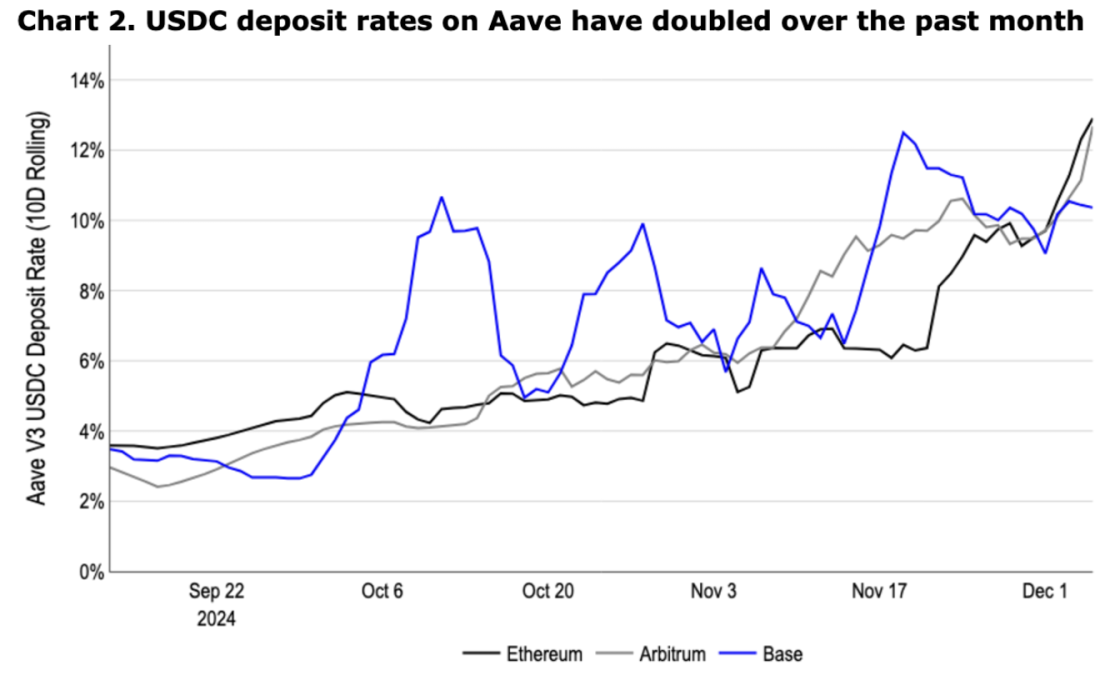

David Duong and David Han, analysts from Coinbase, emphasized that the increase in stablecoin market capitalization shows that investors are looking for ways to exploit the rising yields offered by DeFi lending protocols.

“We think this represents new capital entering the space looking to take advantage of high lending rates (3x higher than long-term bond yields) or looking for higher on-chain beta transactions.”

According to DeFiLlama data , the stablecoin market cap surge began around November 5, coinciding with Donald Trump’s victory in the U.S. presidential election. Coinbase analysts also noted that interest rates on USDC deposits on Aave doubled over the past month.

“Stablecoin lending and borrowing rates have skyrocketed, reaching 10-20% annualized on Aave and Compound across most deployed networks including Ethereum and Base.”

They also noted that the total value locked in lending protocols hit an all-time high of $54 billion, surpassing the previous bull market peak of $52 billion.

In addition to the increased lending rate, Ethena’s yield-bearing token, sUSDe, has seen a significant increase in its annualized percentage return, jumping to over 24%. This is up from around 13% in early November. However, according to information from DeFiLlama, there is a possibility that sUSDe’s APY will drop below 19% next month, which could affect investors.

Coinbase analysts also pointed out that there are attractive emerging opportunities involving higher yielding assets, such as HyperLiquid’s HYPE token and newly introduced AI protocols. They emphasized that these higher yields are primarily reserved for blockchain-based participants, which encourages investors to participate in decentralized platforms to take advantage of such promising potential opportunities.

The analysts noted that “the continued strength of Bitcoin and other major cryptocurrencies has driven significant on-chain activity across a variety of areas, including decentralized transaction volume, lending and borrowing activity, and stablecoin growth.”

This article is for informational purposes only and does not constitute formal investment advice. We strongly advise investors to conduct their own research and consider all relevant information carefully before making any decisions. Please note that we are in no way responsible for any investment decisions you make.